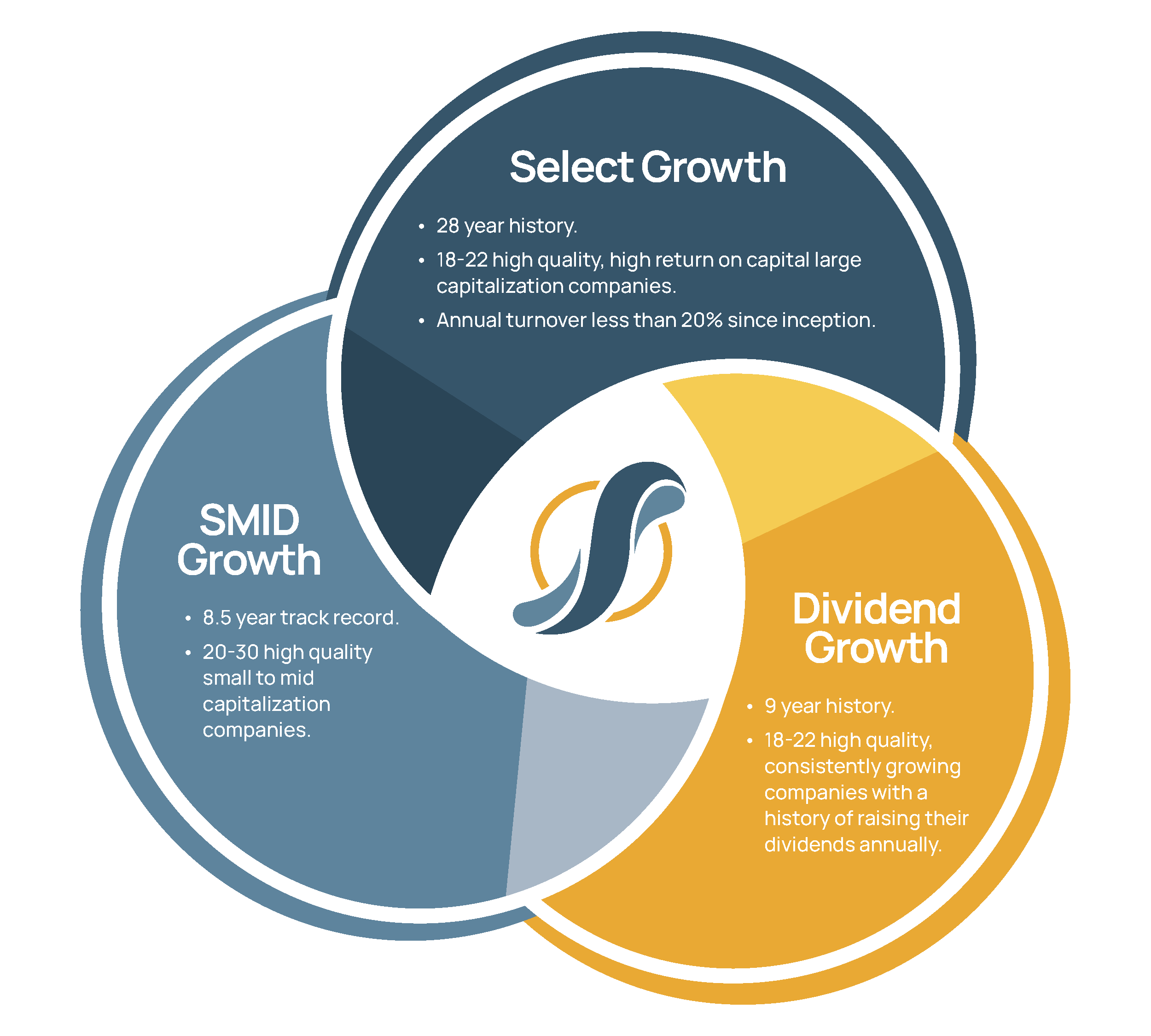

Select Growth

- 28 year history.

- 18-22 high quality, high return on capital large capitalization companies.

- Annual turnover less than 20% since inception.

- Ranked in the top 10% Large-Cap Growth & Large-Cap Core equity peer groups since inception, net of fees.¹

- 28 year track record that has achieved an annualized alpha of 3.68 (gross) and 2.62 (net) of fees vs the S&P 500 with a beta of only 0.83 (gross) and 0.83 (net) .¹

- Since inception, has achieved a 95.34% (gross) 90.99% (net) upside market capture with only a 73.76% (gross) 76.68% (net) downside capture.¹

- Portfolio managed by a team that has been together for 18 plus years with no turnover and is one half represented by women.

- Investment team and senior firm leadership has significant personal assets invested in the strategy.

- All employees have personal assets invested in the strategy through the company pension and profit-sharing plan.

¹ Data source: eVestment, Global Large Cap Growth & Large Cap Core Equity peer group, since inception annualized performance net of fees from 12/31/1997-12/31/2025). Accessed December 31, 2025. Past performance is not indicative of future results.

Fact Sheet

Dividend Growth

- 9 year history.

- 18-22 high quality, consistently growing companies with a history of raising their dividends annually.

- The current risk adjusted ranking is in the top 1% of the eVestment US Dividend Focus Equity peer group and has consistently outperformed the S&P while incurring less risk based on standard deviation, net of fees.¹

- Awarded Silver Status for SMArtX Advisory Solutions Q3 2025 Select List, one of the largest TAMP’s in the industry.

- Assigned 5 stars by Morningstar.¹

- Annualized alpha of 2.19 (gross) 1.23 (net) with a beta of 0.84 vs the S&P 500.¹

- Since inception, has achieved a 89.07% (gross) 85.38% (net) upside market capture with only a 77.60% (gross) 79.97% (net) downside capture. ¹

¹ Data source: eVestment, US Dividend Focus Equity peer group, since inception annualized performance net of fees from 12/31/2016-12/31/2025). Accessed December 31, 2025. Past performance is not indicative of future results.

Fact Sheet

SMID Growth

- 8.5 year track record.

- 20-30 high quality small to mid capitalization companies.

- The track record is ranked in the top 5% and top 15% range of the eVestment Small-Mid Cap Core & Small-Mid Cap Growth equity peer group since inception respectively, net of fees.¹

- Annualized alpha of 3.58 (gross) 2.76 (net) with a beta of 0.93 vs the S&P 400 Growth.¹

- Since inception, has achieved a upside capture of 109.39% (gross) 106.26 (net) with 92.44% (gross) 94.34% (net) downside capture.¹

¹Data source: eVestment, Global SMID Cap Growth & SMID Cap Core Equity peer group, since inception annualized performance net of fees from 6/30/2017-12/31/2025). Accessed December 30, 2025. Past performance is not indicative of future results

Fact Sheet