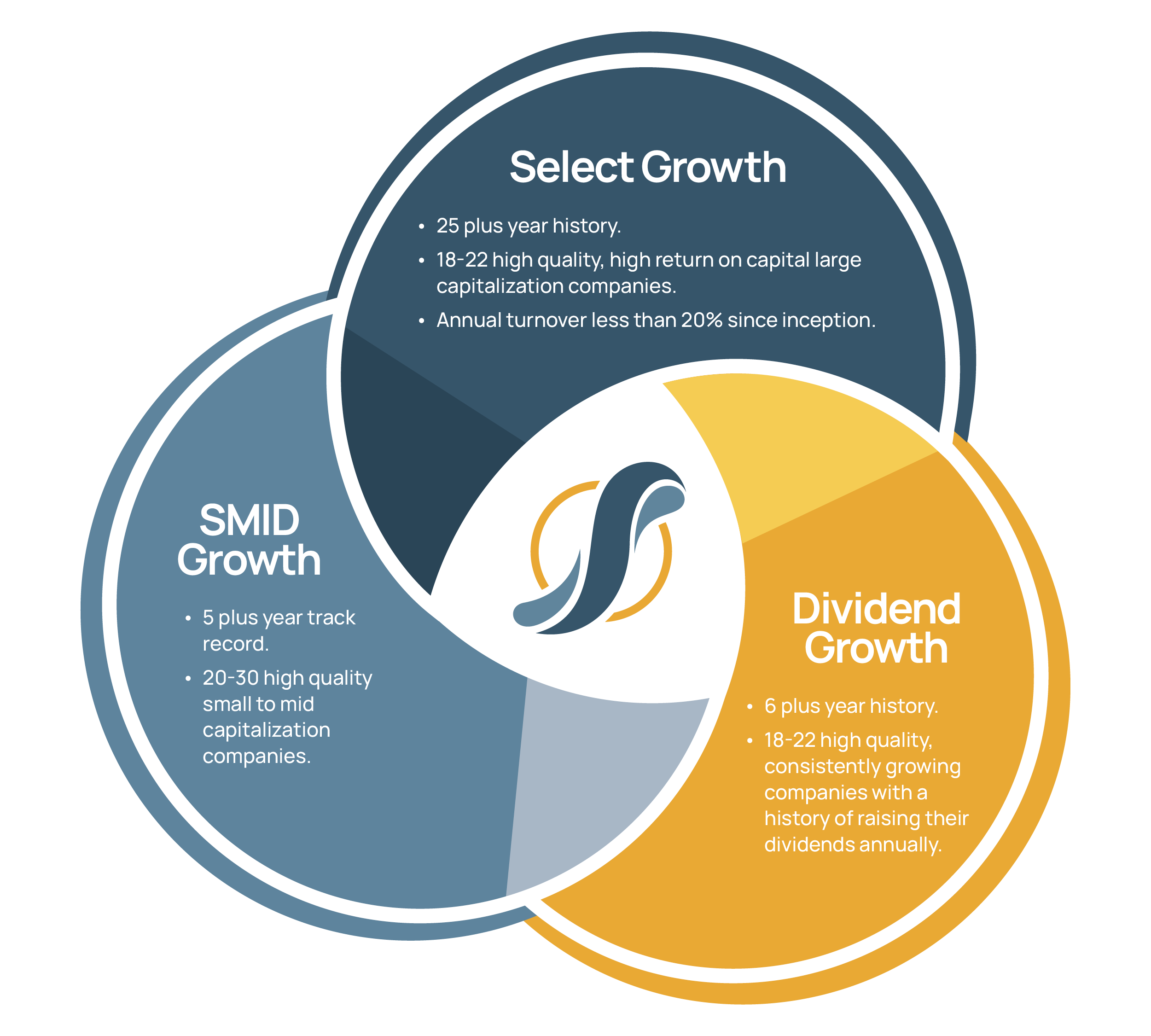

Select Growth

- 26.50 year history.

- 18-22 high quality, high return on capital large capitalization companies.

- Annual turnover less than 20% since inception.

- Ranked in the top 10% in both the eVestment Large-Cap Core and Large-Cap Growth Equity peer groups since inception.¹

- 26.50 year track record that has achieved a annualized alpha of 4.00 (vs the S&P 500) with a beta of only .83, gross of fees.¹

- Since inception has achieved a 96.36% upside market capture ratio with only a gross 72.74% downside capture ratio, gross of fees. ¹

- Portfolio managed by a team that has been together for 17 plus years with no turnover and is two thirds represented by women/minorities.

- Investment team and senior firm leadership has significant personal assets invested in the strategy.

- All employees have personal assets invested in the strategy through the company pension and profit-sharing plan.

¹ (Source: eVestment 12/31/1997-6/30/2024)

Fact Sheet

Dividend Growth

- 7.50 year history.

- 18-22 high quality, consistently growing companies with a history of raising their dividends annually.

- The current risk adjusted ranking is in the top 1% of the eVestment US Dividend Focus Equity peer group and has consistently outperformed the S&P while incurring less risk based on standard deviation.¹

- Awarded best large cap strategy of 2021 by SMArtX, one of the largest TAMP’s in the industry.

- Assigned 5 stars by Morningstar.¹

- Annualized gross alpha is 3.61 with a beta of 0.87 vs the S&P 500.¹

- Since inception, this strategy has achieved 100.03% of the upside and 82.99% of the downside capture, gross of fees.¹

¹ (Source: eVestment 12/31/2016-6/30/2024)

Fact Sheet

SMID Growth

- 7.00 year track record.

- 20-30 high quality small to mid capitalization companies.

- The track record is ranked in the top 5% and top 25% range of the eVestment small-mid cap core/small-mid cap growth equity peer group since inception respectively.¹

- Annualized alpha is 4.64 with a beta of 0.95 vs the S&P 400 Growth, gross of fees.¹

- Since inception upside capture of 119.09% with 97.92% downside, gross of fees.¹

¹(Source: eVestment 6/30/2017-6/30/2024)